Retail Landlords Control a Tight Property Market

Industry Professionals at Annual Conference Say It’s the Flip-Side of What’s Facing Office Owners

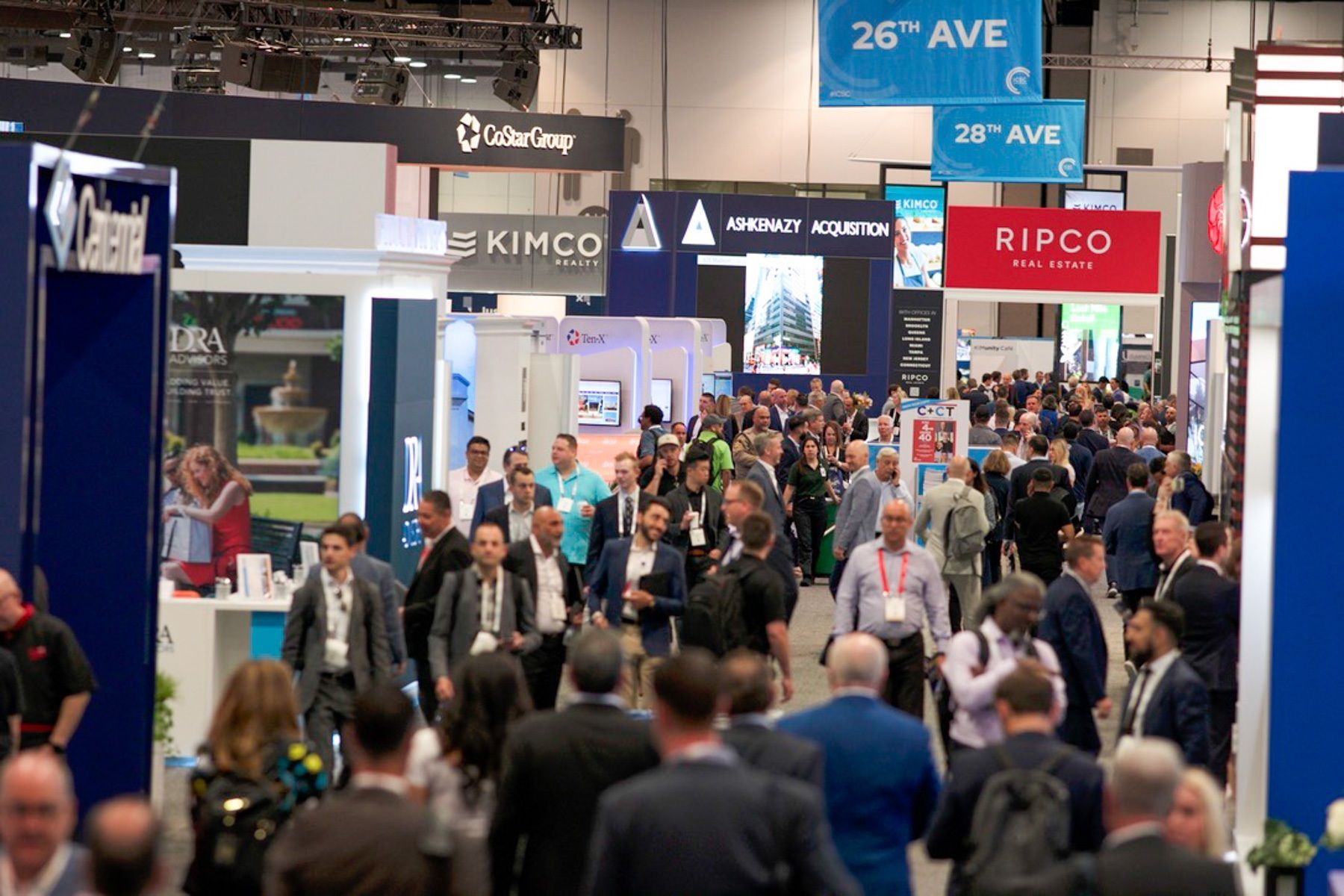

If there was a single message from this year's ICSC trade group conference in Las Vegas, it's that retail landlords that operate prime, in-demand locations are seen as firmly in the driver's seat.

Vacancy rates at historic lows and a stagnant construction pipeline have combined to create a market in which tenants are often forced to be less choosy in what space they take in order to open additional locations, a trend industry analysts predict may not change anytime soon as retailers remain bullish on expanding their real estate portfolios. The floor of the Las Vegas Convention Center was buzzing Monday, the premier day for the show. Executives including David Lukes, CEO of retail landlord Site Centers, said his schedule was packed with meetings that could lead to new leases. Other landlords such as Don and Paul Ghermezian, members of the family that owns Triple Five, were at their company's booth promoting to a stream of prospective tenants their giant properties that include Mall of America in Minnesota.

The demand that played out at the trade show is also going on across the country, where a variety of companies so far have plans to open 3,749 stores this year, according to Coresight Research. McDonald's, for example, already operates a 14,000-location U.S. portfolio and plans to debut another 1,000 within the next five years. It acknowledges but is undaunted by retail's high occupancy rate. "There is a dearth of retail space in the market," Tabassum Zalotrawala, said McDonald's senior vice president and chief development officer, on a panel at the show. "This is the truth. There's not a lot of new shopping centers going out there, and so one of the things that's going to be top of mind is, for my team, is creativity. We've got to become innovative." That's not to say that the retail property industry, on both the landlord and tenant side, doesn't have concerns. At various conference panels, brokers and retail analysts talked about soaring construction costs, worries about curtailed consumer spending this year and the high cost of labor and the difficulty in finding workers.

BMO Capital Markets issued a report with its views — some expressing caution about the industry — from the conference. It said that while tenant demand is healthy now it may have peaked, and that a fallout of smaller tenants appears to have started.

It's a near-opposite position compared to property owners in the office market, many of which are faced with unprecedented amounts of available space and few tenants willing to take it. Office users over the past several years have handed back more space than they've taken on, and lease sizes have shrunk roughly 20% as a result of dwindling demand as many tenants have downsized as they jump to newer, nicer buildings they otherwise wouldn't have been able to afford.

Reduced Space With retail, however, even the companies that used to dictate leasing terms have been forced to become more flexible as the amount of available space has edged lower.

Historic-low retail vacancy rates have made it challenging for tenants such as Starbucks and McDonald's to find sites for future locations. (CoStar)

From large fast-food chains such as McDonald's to more fledgling businesses, tenants across the spectrum expressed the need for creativity when it comes to deal-making and adapting to the spaces they can find. Some brokers said the historically low vacancy rate is giving landlords in the right locations the upper hand in lease negotiations, putting pressure on publicly traded companies that remain committed to expanding their store footprints.

"How do you sustain growth when you seemingly are everywhere already?" Naveen Jaggi, president of retail advisory services at JLL, said at the show.

For Starbucks, a coffee chain nearing 10,000 locations across the United States, that has meant homing in on areas where it doesn't yet have a presence and solving out the spatial equation from there, its executives explained to ICSC attendees.

"We aren't just limited to the larger developers," said Angele Robinson-Gaylord, senior vice president of Americas store development for Starbucks. "We can certainly take infill locations. We can have smaller footprints. It's about the evolution of our formats [and] bringing more cups to market and ensuring that [landlords] understand the value that Starbucks can bring to their developments."

Retail Armageddon? Brokers Say No, Vacant Stores Should Find Eager Tenants. Landlord leverage takes other forms as well. New York-based developer Ashkenazy Acquisitions, for example, is avoiding tenant improvement allowances and putting the onus on incoming retailers to finish out their spaces.

"It's become about how can I give a tenant the space with as little work as possible," said Julie Fox, the firm's senior vice president of leasing and development. "We just need to get the numbers to work on the rent and the delivery, so we prefer to give more rent abatements. A lot of tenants would prefer that we do the work, but as landlords, if we have to finish out a vanilla box, that's eating into time before I can even deliver the space to a tenant and before they can even start construction." The ICSC annual trade show in Las Vegas brings thousands of professionals across the retail and commercial real estate industries together. (Michael Hirsch/CoStar)

Store closings have surged in recent months due to a handful of decisions among retailers such as Macy's, Express and Family Dollar to shutter what will amount to hundreds of locations. Demand Optimism. Even so, some brokers and landlords at ICSC were more than optimistic that those vacancies wouldn't sit around empty for long. Across the United States, the average retail vacancy rate has fallen to about 4%, according to CoStar data, one of its tightest positions on record. The demand for retail space jumped nearly 42 million square feet over the past year and by more than 200 million square feet since the start of 2021, according to CoStar data. Tenant move-outs have dropped by nearly 20% over the past three years. That's a big turnaround from the past. In early 2009, the United States hit 56.5 square feet of retail space per capita, a high-water mark for shopping center space that followed a surge in retail space expansion. But the amount of retail space per capita within the largest 45 U.S. retail markets has steadily declined, recently dropping to a multidecade low, Brandon Svec, CoStar Group's national director of U.S. retail analytics, said last year. He cited the lack of new construction of shopping centers and malls as a big factor in that decrease, as well as the fact that over 130 million square feet of retail space had been demolished over the past five years alone.

Lack of Venture Capital Forces Some Retailers To Reevaluate Brick-and-Mortar Expansions

For projects moving through the development pipeline, the focus has been more on mixing a variety of uses so retail properties can attract more people at more points throughout the day. Show attendees could try out one type of booming activity that's attracted lease deals across the country: pickleball. Venue operator The Picklr set up a court where people could play. "The consumer has less time, and we have to meet those time needs," said Mark Hunter, a managing director of retail asset services for CBRE. "Besides incorporating entertainment, that means bringing in more food and beverage and other uses such as coworking and medical. Retail development is at a historic low, so now only is the consumer requesting that we listen better, but retailers that probably would have never looked at places like a mall are now considering it." Mark Hunter, a managing director of retail asset services for the brokerage CBRE, talked about space being used for coworking and medical uses at the ICSC trade show in Las Vegas. (Michael Hirsch/CoStar)

Mall redevelopments, in particular, have reduced what were previously vast amounts of storefront space in order to reallocate it for uses such as housing, events, outdoor parks and — where it works — offices. For Poag Development Group's Greg Whitney, the firm's senior vice president of development, the process of figuring out the ideal balance involves analyzing malls on a property-by-property basis to come up with specific ways that layer reasons for people to visit.

Different Approaches

"The solution set for malls is much more varied," he said. "You'll have different solutions for each, and some malls are complete teardowns that you have to completely redesign. But they all mean creating a different experience that maybe includes more restaurants or public spaces or residential or office, at least in a market that can support an office environment." That process takes time, however, and professionals such as Whitney expressed frustration at hurdles such as lining up the necessary permits, putting together the necessary construction teams and getting a project across the finish line — especially for the bigger redevelopment endeavors.

"It is very difficult to redevelop some of these properties," he said, pointing to property types such as older malls. "There are all kinds of landmines and obstacles you have to weave through and navigate just to get to the land, and that's not even including the civic or government component to all of it."

Similar to retail, stakeholders in the office market are predicting that the sector's vastly reduced construction pipeline will ultimately shift some of the power back to landlords. Executives at developer firms such as Boston Properties and Kilroy Realty have expressed optimism that the absence of newly constructed space could spell higher demand for what is available, following the same footsteps as the retail market's evolution over the past several years.

While much remains to be determined, that lack of incoming space for both sectors of the commercial real estate market is expected to have a lasting effect on the power dynamics between most landlords and tenants across the country. "Even when you think you get it right, development costs today are out of control," CBRE's Hunter said of the retail market. "It's almost impossible to develop today unless you can see a considerable lift in rents that are possible to achieve. You have to solve problems today that you didn't have to four or five years ago, so if you were planning a project years back, you're already behind."

By Katie Burke and Linda Moss

CoStar News